Understanding what makes headlines is essential for effective B2B communications.

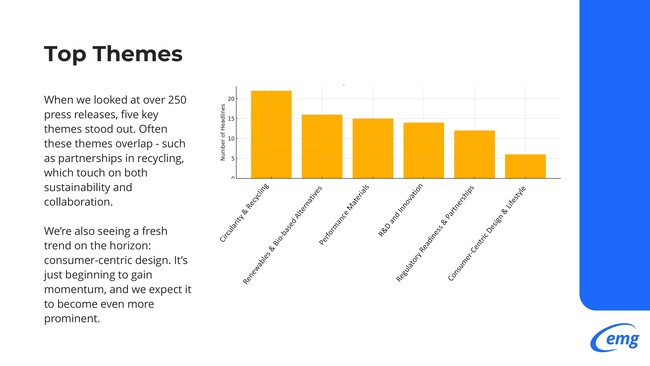

Our Industry Trends Report examines media coverage patterns across the polymers and chemicals sector, analysing over 250 press releases and their resulting coverage in 10 key trade media publications throughout the past year.

This rigorous analysis reveals which themes capture journalists' attention, what types of stories generate the most engagement, and how leading companies are positioning themselves in an evolving market landscape. Beyond simply identifying trends, our research uncovers the specific narrative approaches that deliver the greatest visibility.

Let's explore the six key trends that our research has identified.

Circularity and recycling take centre stage

The transition to circular economy principles has moved beyond sustainability initiatives to become a fundamental business imperative. Plastics recycling technologies, feedstock recovery systems and closed-loop solutions are experiencing remarkable growth thanks to heightening consumer demand, regulatory pressure and brand commitments.

Media coverage consistently prioritises stories that demonstrate tangible circularity benefits, particularly when companies showcase how they're solving practical problems for customers. Announcements about advanced recycling technologies, car-to-car plastics recycling and partnerships across the value chain are generating the highest visibility.

Companies like SABIC and Covestro are positioning themselves at the forefront by highlighting collaborative efforts with recyclers and product manufacturers – they have been adept at presenting circular solutions not just as environmental necessities, but as profitable business models.

Renewables and bio-based alternatives gain market share

Biomass-balanced polymers, chemically recycled content and renewable raw materials are rapidly moving from niche applications to mainstream adoption. This shift is driven by plastic converters and brand owners seeking to meet increasingly ambitious carbon reduction targets.

The most successful communications in this area focus on how these alternatives overcome previous technical limitations whilst delivering comparable or superior performance. Forward-thinking companies are highlighting their investments in renewable feedstocks and demonstrating how these innovations help customers meet their own sustainability commitments.

The narrative has also evolved from theoretical environmental benefits to practical implementation stories, with media especially receptive to examples of bio-based materials being used in demanding real-world applications.

Performance materials continue to drive innovation

While sustainability dominates headlines, performance characteristics remain critical for material selection across automotive, electronics and packaging applications. High-performance thermoplastics, lightweight composites and functional additives continue to generate significant interest, especially when linked to emerging sectors such as electric vehicles and renewable energy infrastructure.

Companies that communicate how their materials simultaneously address sustainability concerns and performance requirements achieve the greatest media visibility. Coverage in this area is particularly strong when it is tied to specific industry challenges, such as lightweighting for EVs or thermal management for electronic components.

R&D and innovation create competitive advantage

Investment in research capabilities, compounding technologies and digital design tools features prominently across industry announcements. Media coverage rewards companies that demonstrate how their R&D initiatives directly address current market challenges and anticipate future needs.

We're observing increased attention to innovation narratives that highlight cross-disciplinary collaboration. This is especially true when they involve partnerships between chemical companies, equipment manufacturers and digital technology providers. Companies leveraging advanced simulations, artificial intelligence and high-throughput experimentation in their development processes are gaining more attention.

Regulatory readiness and partnerships build trust

With circular economy legislation, chemical registration requirements and product safety regulations continuing to evolve, companies are increasingly highlighting their regulatory expertise as a competitive advantage. Announcements about traceability systems, ISCC PLUS certification and compliance initiatives attract significant coverage.

Strategic partnerships formed specifically to address regulatory challenges are emerging as a powerful narrative. Media stories featuring industry collaborations to develop methods for recycled content verification, chemical circularity standards or sustainable material classifications demonstrate how the sector is proactively addressing regulatory requirements.

Consumer-centric design emerges as a differentiator

A fresh trend gaining momentum in the traditionally B2B chemical sector is the focus on consumer-facing applications. Products in wearable technology, sports equipment, beauty packaging and wellness goods, for example, are bringing polymer innovations directly to end-users, and therefore creating new storytelling opportunities.

This emerging area represents a significant opportunity for companies looking to differentiate their messaging. By highlighting how their materials enhance consumer experiences whilst meeting sustainability expectations, chemical manufacturers are finding new ways to humanise their brands and communicate value beyond technical specifications.

As we progress through 2025, these trends will continue to shape the polymers and chemicals landscape. Success will increasingly depend on companies' ability to develop integrated narratives that align with these key themes whilst highlighting their unique positioning and value proposition.

Want to learn more about communicating your polymer and chemical innovations effectively? Contact our team to discuss how EMG can support your communications strategy.